how are rsus taxed at ipo

In contrast two types of stock options exist and are taxed differently from one another. With RSUs you are taxed when the shares are delivered which is almost always at vesting But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company so I suspect its not always when the shares are delivered.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

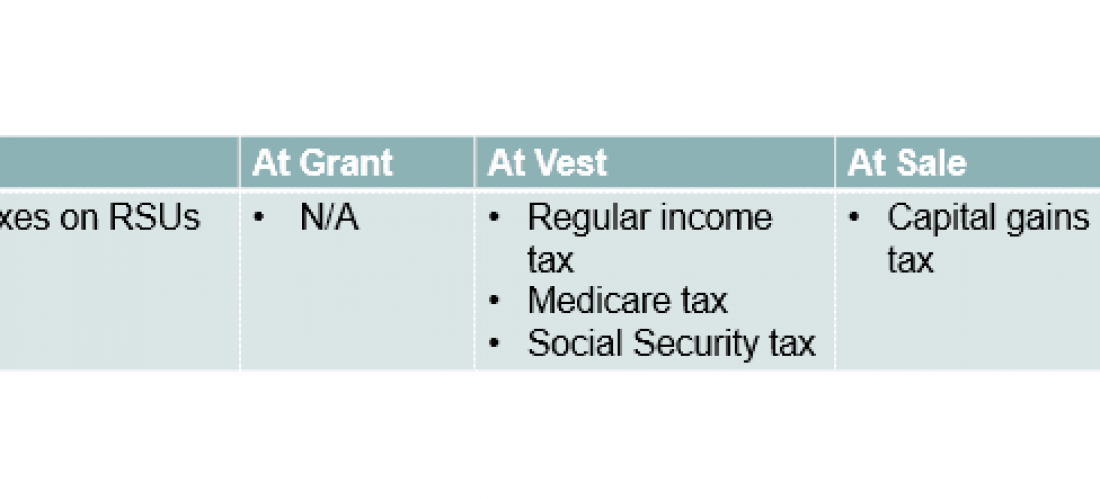

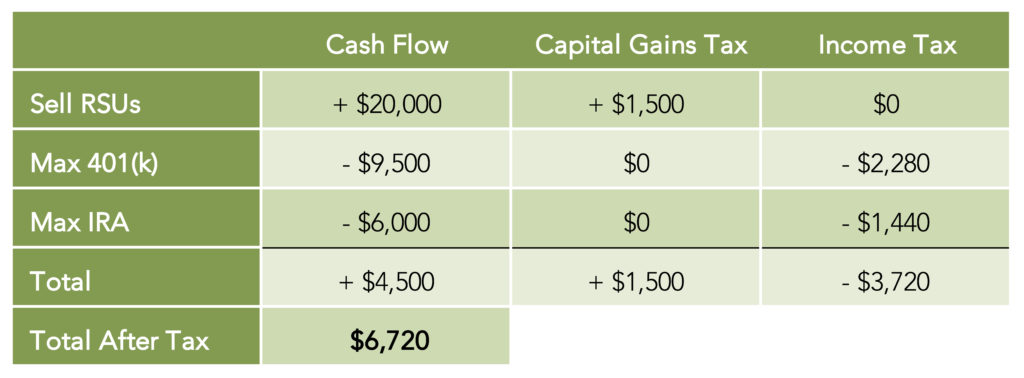

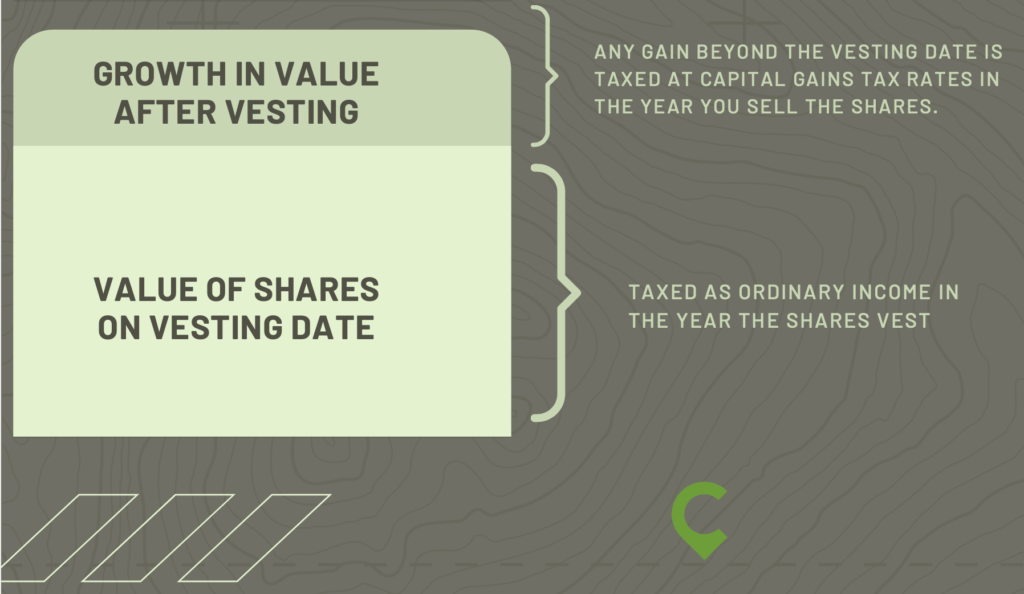

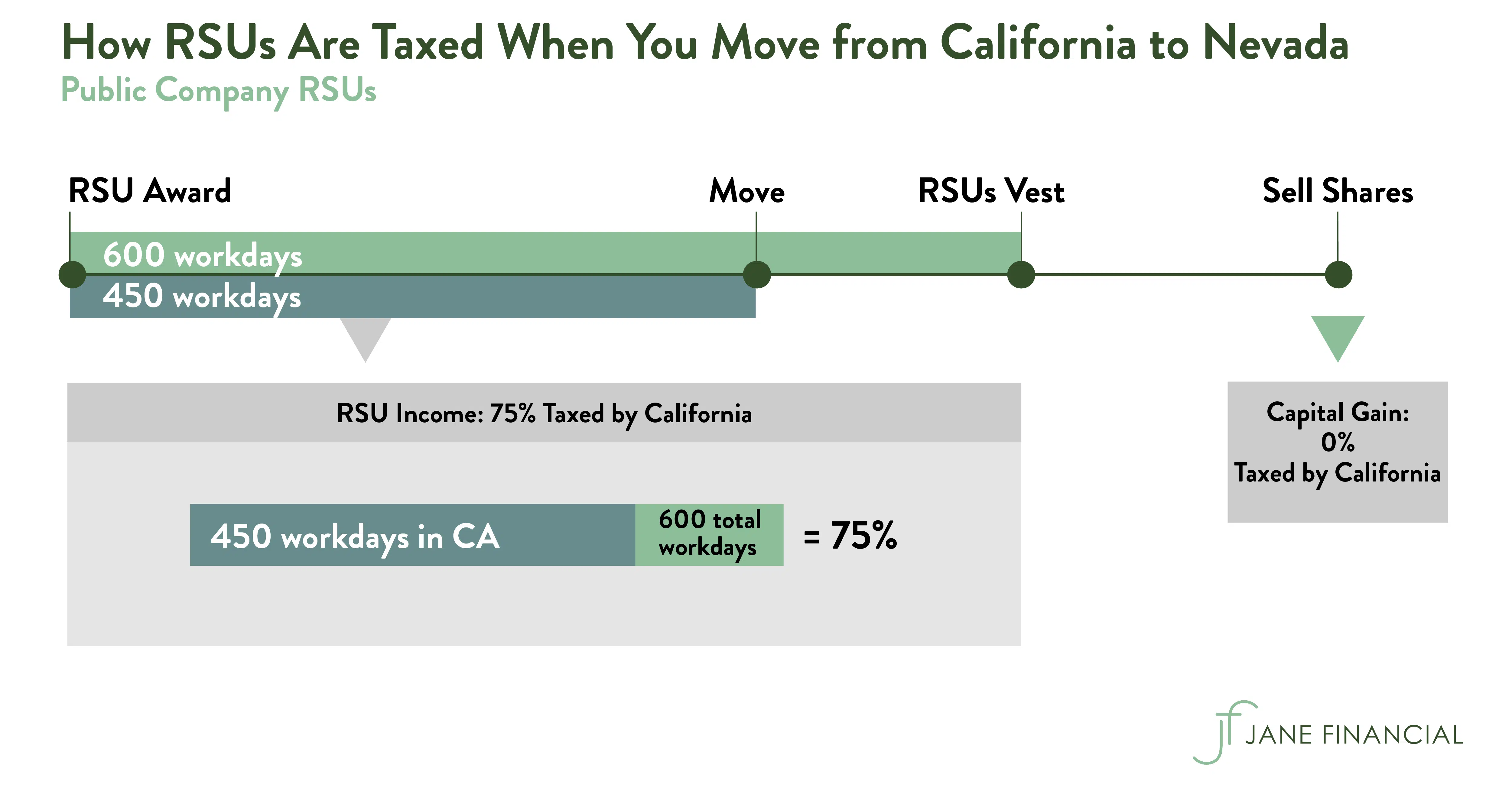

Gains on RSU stocks are taxed at the capital gains tax rate.

. All your vested RSUs will be granted on the day of IPO so you will have only 1 vesting event. My grant price per RSU was 20. Post IPO vesting causes your tax bracket to explode to higher levels regardless of whether you sell the RSUs.

Taxable amounts are based upon FMV at the time of shares are granted. RSUs are taxed as ordinary income as of the date they become fully vested using the FMV of the shares on the date of vesting. I vested 2 years worth of RSUs before the company IPOed at 50.

The current market value keeps changingI. Youre taxed when receiving RSU-associated shares. As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now grappling with the fallout on their tax bills after last Mays disappointing IPO.

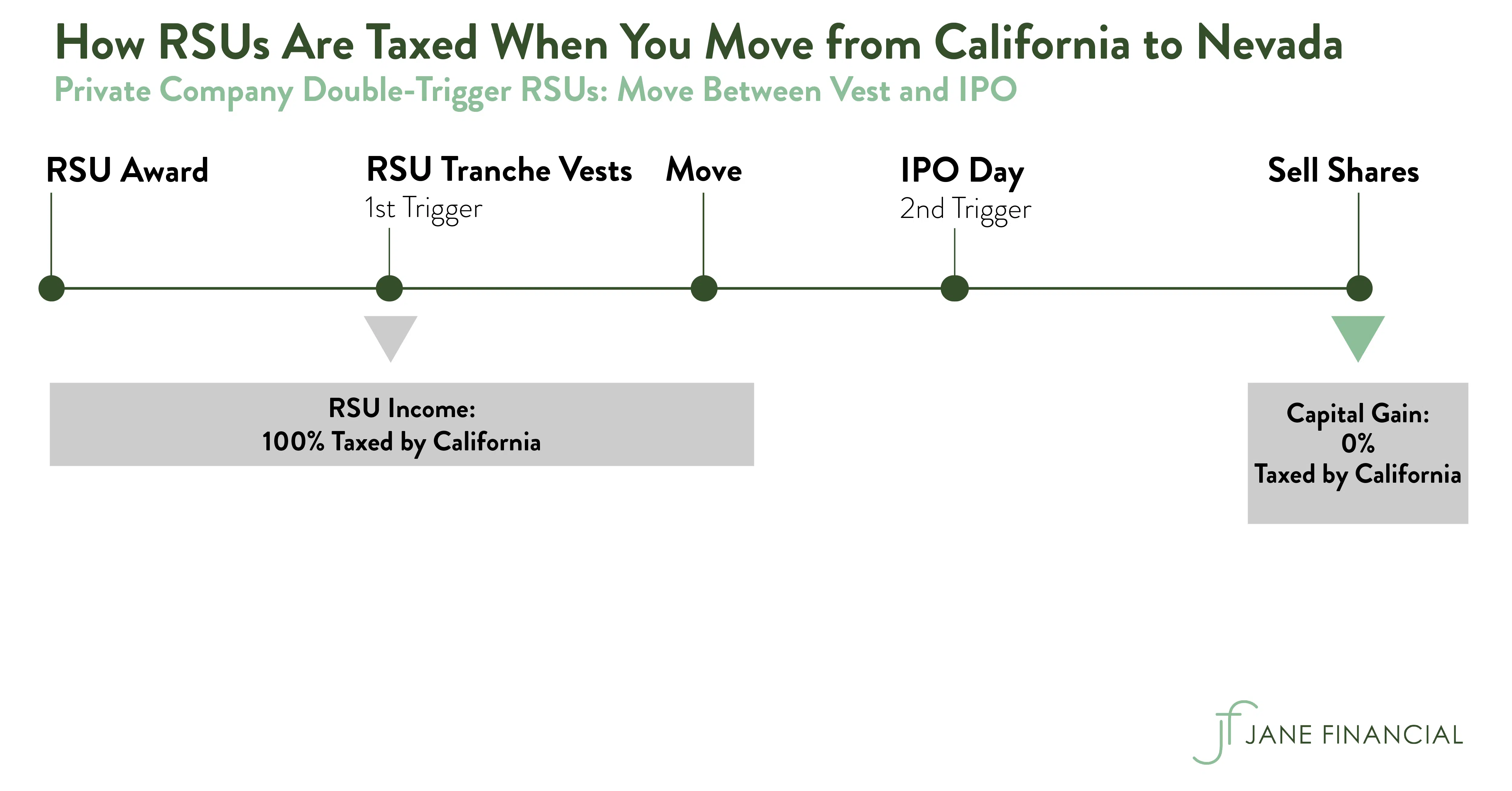

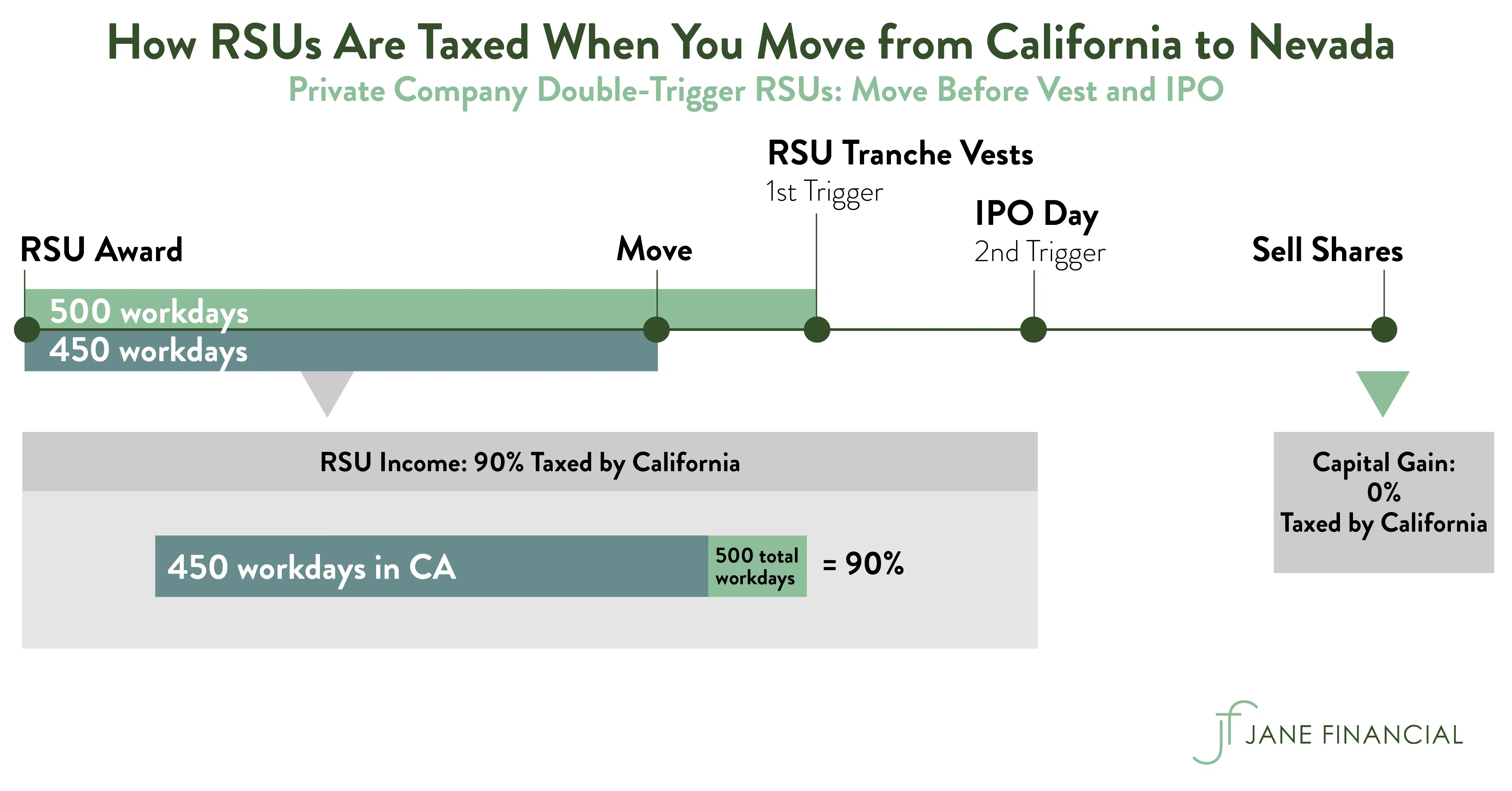

As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now grappling with the. Regardless of market fluctuations an RSU always has value. If RSUs vest while youre at a private company they usually wont be taxed until your company goes public.

How Are Restricted Stock Units RSUs Taxed. For estimating future taxes. However you will need to input your best guess in terms of what the stock price will be at a.

Ad Earn up to 600 when you fund a new account by August 17th. Your company has its IPO. And sometimes wont become taxable until after lock-up like in Rivians case.

Hi Blind making some numbers up to stay anonymousI was given 100k worth RSUs vestable quarterly over 4 years. Once they vest they get taxed and they are in your possession. Your RSUs vest and become taxable 180 days after Event 2.

Prior to an IPO the company may have a. Ad Thinking of switching from stock options to RSUs restricted stock options. Meanwhile a fateful decision by Uber that could have delighted these people is only aggravating.

Compare how the total payout may change between options and RSUs. Palantir DPOed and had no lockup on RSUs so everyone could sell to cover taxes immediately on listing day. RSU tax is treated differently from stock options.

IPO Pitfall 1 - Taxes Withholding Preferences If a company is already public RSUs are usually taxable when they vest. Unlike stock options which can go underwater and lose all practical value. Invest in Stocks Options ETFs with Robinhood Financial and Crypto with Robinhood Crypto.

Dec 10 2020 0. FICA taxes and all. 72 54 an 18 per share loss.

Watch out for RSUs. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Prior to an IPO the company may have a.

This means that your RSUs will vest or be considered income after an IPO. Tax rates and tab le. And yes you are able to report capital losses on your taxes but its not pretty.

Input all the shares vested and the IPO price in the boxes below. They have to pay taxes on a 72 tax basis based on the price that the IPO happened and the shares vested. Dec 10 2020 3.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. According to tax law capital losses can ONLY be used to. Your company has its IPO.

No lockupinteresting I thought it is a must per SEC. RSUs or Restricted Stock Units trigger ordinary income tax when they vest and many RSUs have a vesting schedule thats reliant on an IPO. However when they sell theyll only get 54 each.

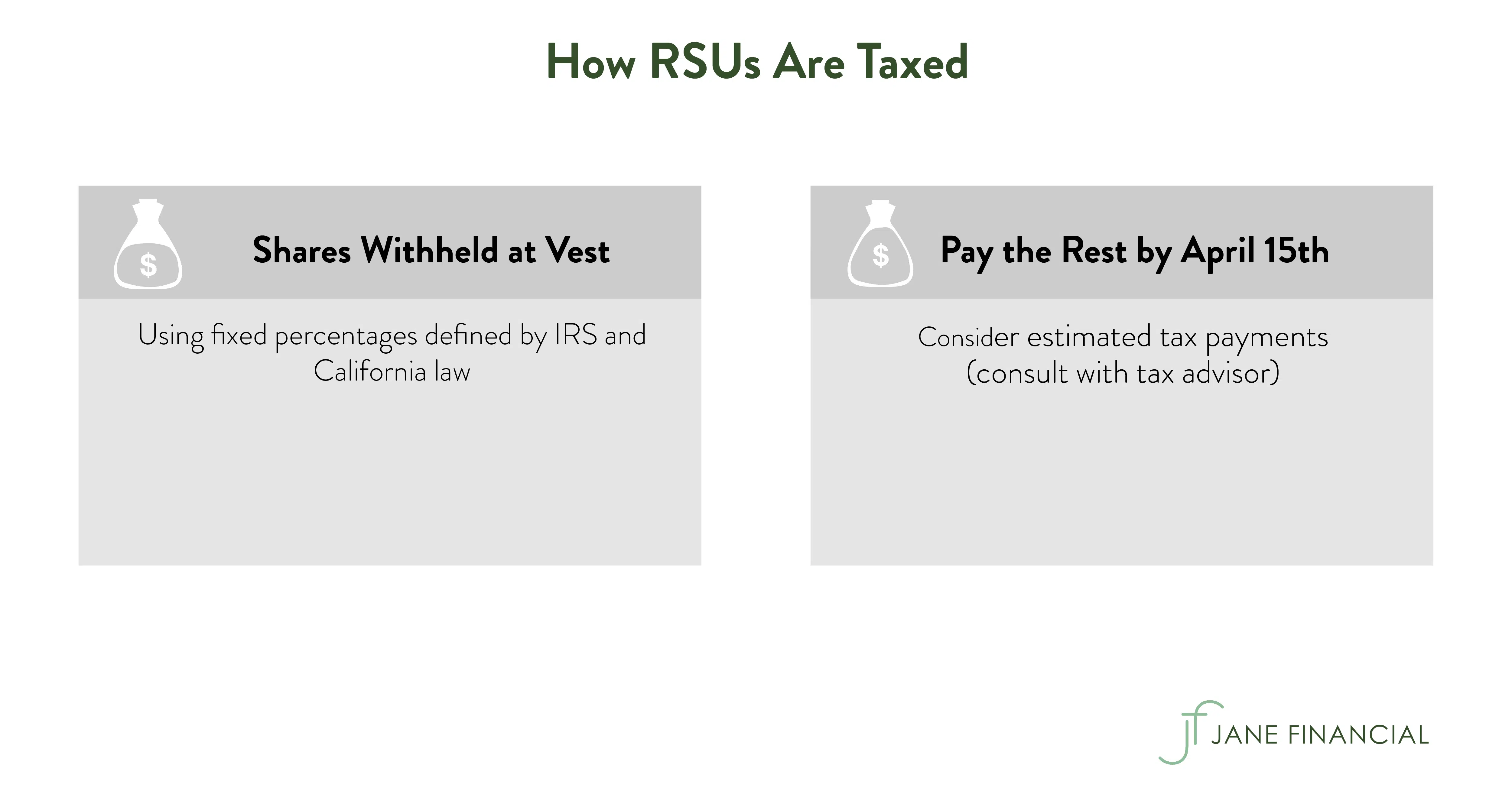

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. With double-trigger RSUs you will face compensation income when all the vested shares are delivered in one batch at the specified time after the second trigger and then also the FICA taxes when the IPO occurs. Your company should withhold a portion of your RSUs at the time of IPO which will help cover a part of or all of your taxes owed.

Wide Range Of Investment Choices Including Options Futures and Forex. For estimating taxes for IPOs. Often less than 1.

RSUs can be frustrating for a couple of reasons. However in the case where the company requires or a participant elects a deferred distribution where shares are not delivered until a later date only FICAFUTA are due at vest Continue Reading Promoted by Masterworks Jul 21. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

You can also use this calculator to estimate your total taxes for the year. Depending on your tax bracket the flat federal withholding rate on stock compensation may not be enough to cover the total tax you really owe on the value of the. Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest.

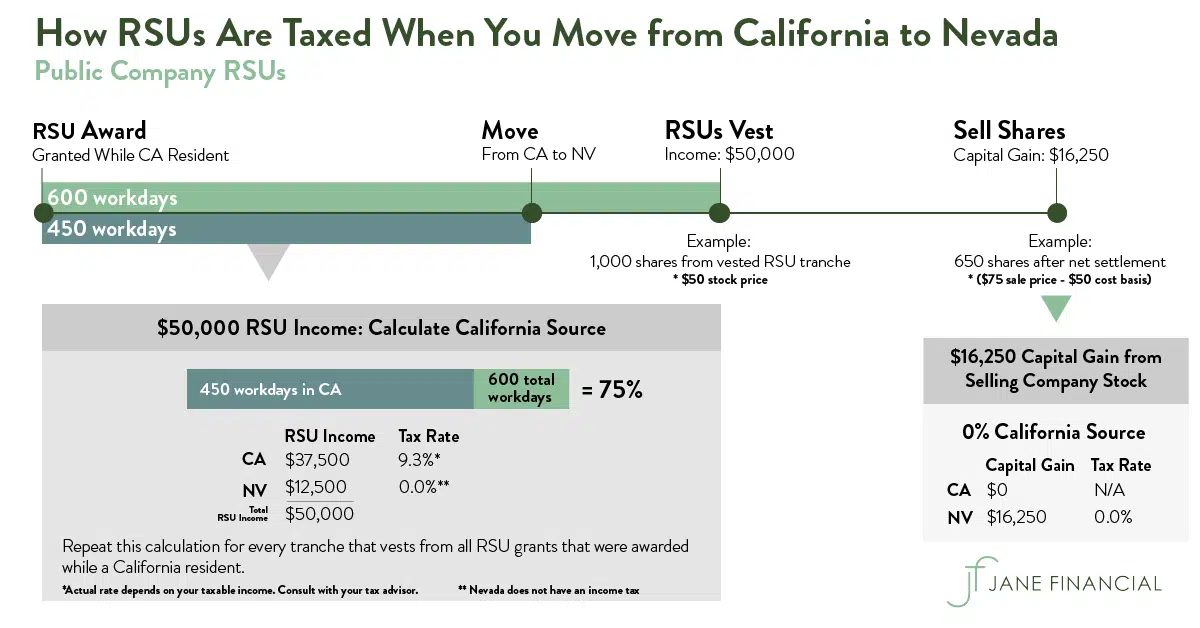

Here is an article on employee stock options. The first is the tax shrink that you will experience from the number of shares you are promised to the number of shares that you get. If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate.

Your company should withhold a portion of your RSUs at the time of IPO which will help cover a part of or all of your taxes owed. Dec 10 2020 2 1. You are granted some RSUs.

With RSUs there are no decisions to be made except for when you sell them. Typically employees need to pay attention to three specific ways that an IPO can impact their taxes. But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company so I suspect its not always when the shares are delivered.

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial